Tag: Saving

-

Structural Constraints on Financial Independence | Part 2

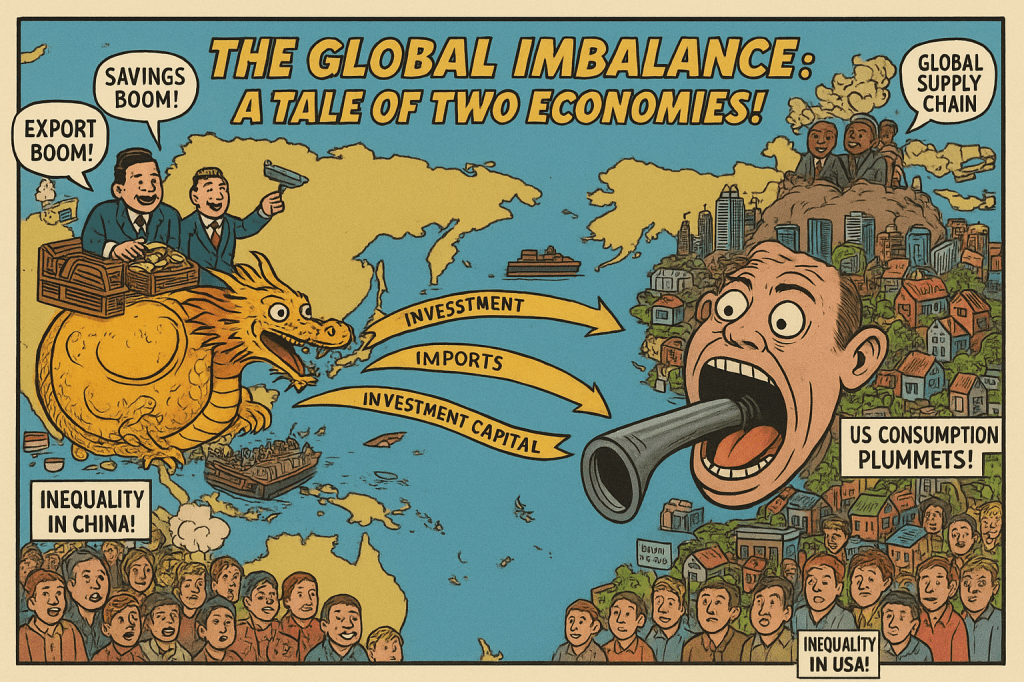

Last week, we argued against the dominant narrative that low household savings and poor retirement outcomes are due to individual deficits in financial education or personal thrift. In doing so, we introduced the “Paradox of Thrift,” explaining how widespread aggressive saving can harm the economy by reducing aggregate demand. We also discussed how asset price…

-

The CAPE ratio, the Merton Share and Your Asset Allocation | Part 1

If you’re part of the Financial Independence (FI) community, you’ve probably built your retirement dreams on a pretty common assumption: stock market returns average 8–10%. To be fair, the S&P 500 has delivered, hitting a 10.2% compound annual return from 1928 through 2024. Popular FIRE calculators like Networthify err on the conservative side and dial…