-

Can Trump Accounts and Superannuation Help Us Afford the Future?

President Trump recently announced a donation of $6.25 by Michael and Susan Dell to kick-start new investment accounts, dubbed “Trump Accounts,” for 25 million qualified American children under 11 years of age. Trump Accounts were established as part of the One Big Beautiful Bill Act (OBBBA) and provide tax deferral for families with children.

-

Is Asset Location Strategy Worth the Effort?

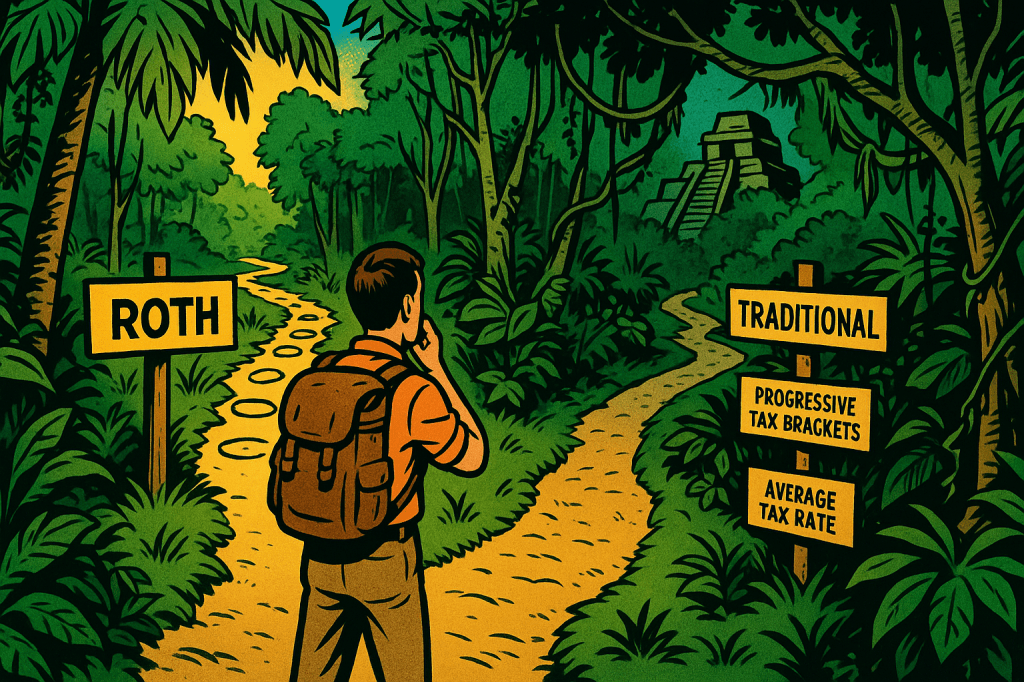

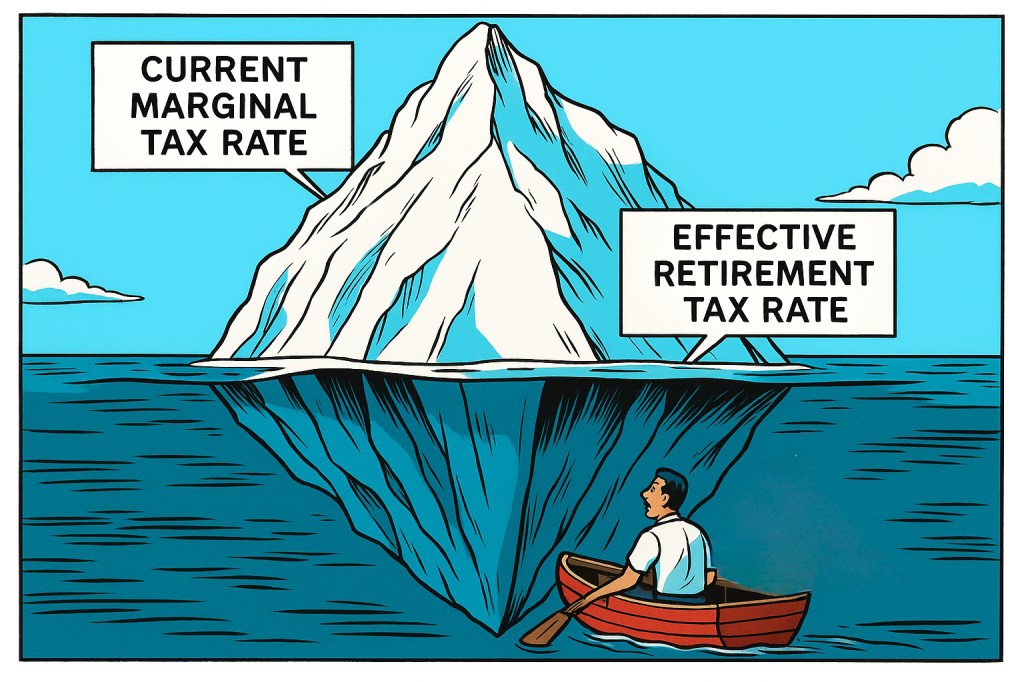

Last week, we discussed the different qualities and benefits of pre-tax accounts like Traditional IRAs and 401Ks compared to Roth accounts. Since then, there were a couple of media discussions that go more into depth on the tax implications of asset location decisions. First, Merit Financial Advisor’s posted an excellent video breaking down the “problems”…

-

How Progressive Taxation Flips the Script on Investment Decision Making

I started reading Sean Mullaney and Cody Garrett’s Tax Planning To and Through Early Retirement recently. I was happy to see Mullaney and Garrett break down the math behind Roth vs. Traditional accounts. Far too many financial planners and influencers use overly simplistic math, stoke fear about impending tax timebombs, or just cheerlead for “tax…

-

Stock Buybacks: A Misallocation of Capital or an Easy Target?

I recently came across two interesting pieces on stock buybacks, which I’ve been meaning to cover at the Fictitious Capitalist. For those who are unfamiliar, stock buybacks—also called share repurchases—are when a company uses its own cash to buy back its shares from the open market (or directly from shareholders). Once repurchased, those shares are usually…

-

Democratization is A Trojan Horse for Wealth Concentration

The contemporary call for the “democratization of finance,” widely championed by FinTech firms, proponents of decentralized assets, and even the President of the United States is founded upon a fundamental political deception. It substitutes technical access to markets for structural power, the collective capacity to control the allocation of credit and capital. Rather than being…

-

Structural Constraints on Financial Independence | Part 2

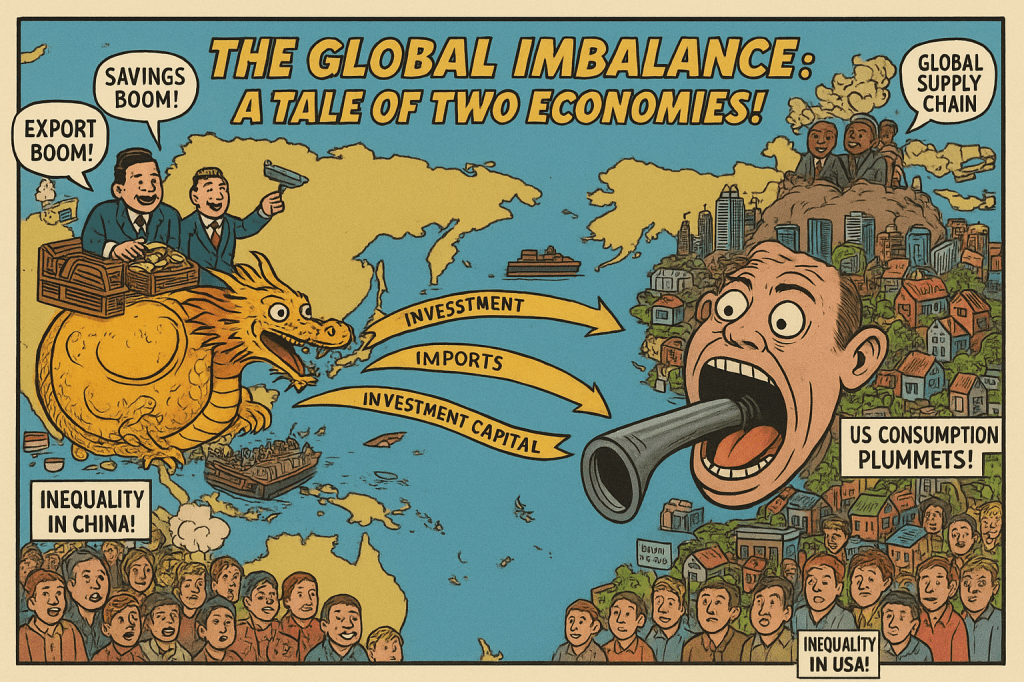

Last week, we argued against the dominant narrative that low household savings and poor retirement outcomes are due to individual deficits in financial education or personal thrift. In doing so, we introduced the “Paradox of Thrift,” explaining how widespread aggressive saving can harm the economy by reducing aggregate demand. We also discussed how asset price…

-

Structural Constraints on Financial Independence | Part 1

Financial Independent (FI) culture, and the broader social and academic discourse, is dominated by a seemingly benevolent, yet deeply flawed, narrative: that low household savings and poor retirement outcomes are primarily the result of individual deficits in “financial education” or personal thrift. This paradigm, heavily promoted by financial institutions and often echoed in public policy,…

-

Is the Lifecycle Model Dead? New Research on Optimal Retirement Asset Allocation

Recently, I’ve been exploring optimal retirement asset allocations. Conventional wisdom suggests that savers should invest more conservatively as they approach retirement. The lifecycle model of investing, for example, posits that an individual’s investment strategy should change over their lifetime based on their age, financial goals, risk tolerance, and time horizon. During accumulation, investors typically have…

-

Lifecycle Investing and Stock Market Mean Reversion

A short follow-up this week to a post a couple of weeks ago when we discussed the stock market’s longest losing streak. At the time, I was working on an asset liability matching exercise to inform my asset allocation. My interest in this topic was inspired by a presentation from Bill Bernstein over at Paul…

-

Don’t Panic!

Equity investing can be gut wrenching. Looking at the exchange value of your investment during a market panic or after a decade or more of lost returns is enough to challenge even the most dedicated investors. Karl Marx marveled at the way “fictitious capital” could bear almost no relationship to the intrinsic value of the…

Fictitious Capitalist

Wealth for the many.