Tag: Investing

-

Beyond the Green Veil: An ESG Postmortem | Part 3

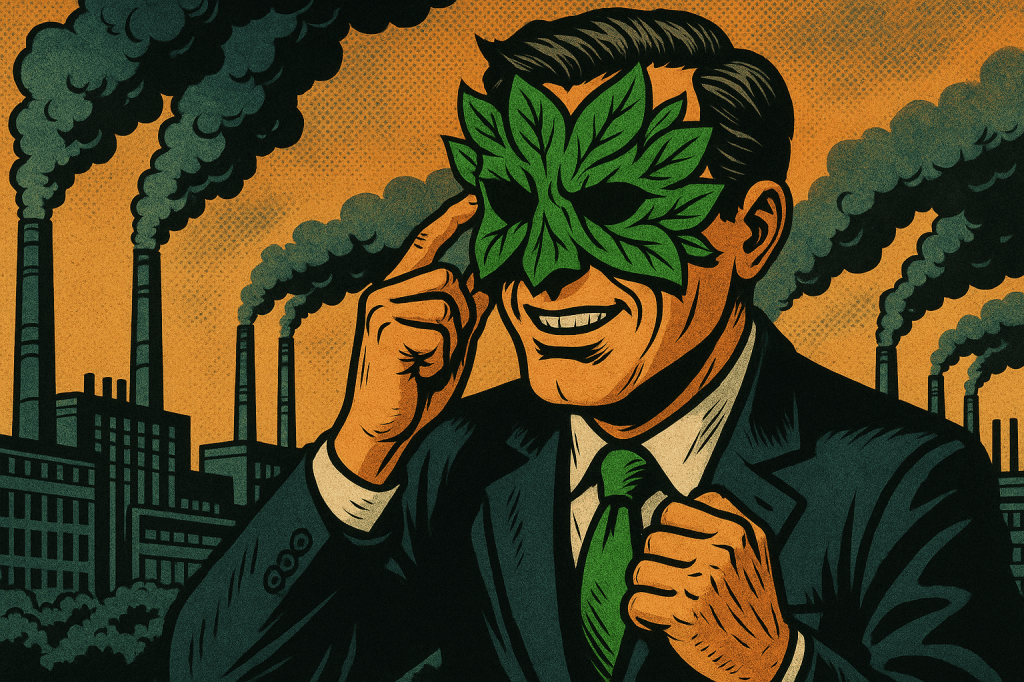

In the previous two posts, we explored how ESG became a worldwide phenomenon, how it courted political controversy and generated critique from politicians, armchair economists and academic journals. In this final post, we’ll explore some deeper critiques through the lens of Marxist economics and offer some potential social democratic and market socialist alternatives to ESG…

-

Beyond the Green Veil: An ESG Postmortem | Part 2

Welcome to the second of three blog posts about the rise and fall of Environmental, Social and Governance (ESG) investing. Last week, we discussed the history of ESG investing along with made by proponents of ESG. This week we’ll discuss some of the popular critiques of ESG and their more academic equivalents. Let’s jump in…

-

Beyond the Green Veil: An ESG Postmortem | Part 1

Environmental, Social, and Governance (ESG) investing emerged as a purportedly transformative force in the financial world, growing at a breakneck pace until very recently. It promised a pathway to align the often-disparate goals of generating superior financial returns with achieving broader environmental and social objectives. This burgeoning asset category, encompassing a wide and evolving array…

-

The CAPE ratio, the Merton Share and Your Asset Allocation | Part 3

In the previous two articles, we teased the Merton Share as a rational framework for portfolio asset allocation. Now, let’s dive into how you can use both the CAPE ratio and the Merton Share to align your portfolio with your investing horizon, risk appetite, and current market valuations, without constant tinkering.

-

The CAPE ratio, the Merton Share and Your Asset Allocation | Part 2

Last week we discussed how the CAPE ratio of the S&P 500 is historically high at over 37, making the expected return on equities relatively low. And when we compare the earnings yield to the real return on 10-year TIPS, we see that the “equity risk premium” is quite small today. However, predicting the future is tough,…

-

The CAPE ratio, the Merton Share and Your Asset Allocation | Part 1

If you’re part of the Financial Independence (FI) community, you’ve probably built your retirement dreams on a pretty common assumption: stock market returns average 8–10%. To be fair, the S&P 500 has delivered, hitting a 10.2% compound annual return from 1928 through 2024. Popular FIRE calculators like Networthify err on the conservative side and dial…

-

How a Water Heater Can Increase Your Wealth

Energy efficiency may be boring, but it can be an incredibly lucrative investment What if I told you there is a way to make a 20 percent annual return on your investment over the next 13 years? What if I also told you that you could make that return with the same low risk associated…

-

Here’s How Much You Really Need to Save for Retirement

Planning for retirement spending is one of the more nuanced parts of financial planning. The Financial Independence community commonly follows the “4% rule,” which was first developed by Bill Bengen in a 1994 paper and later expounded upon in the Trinity Study. The 4% rule dictates that a properly designed portfolio should last at least…