Tag: Financial Independence

-

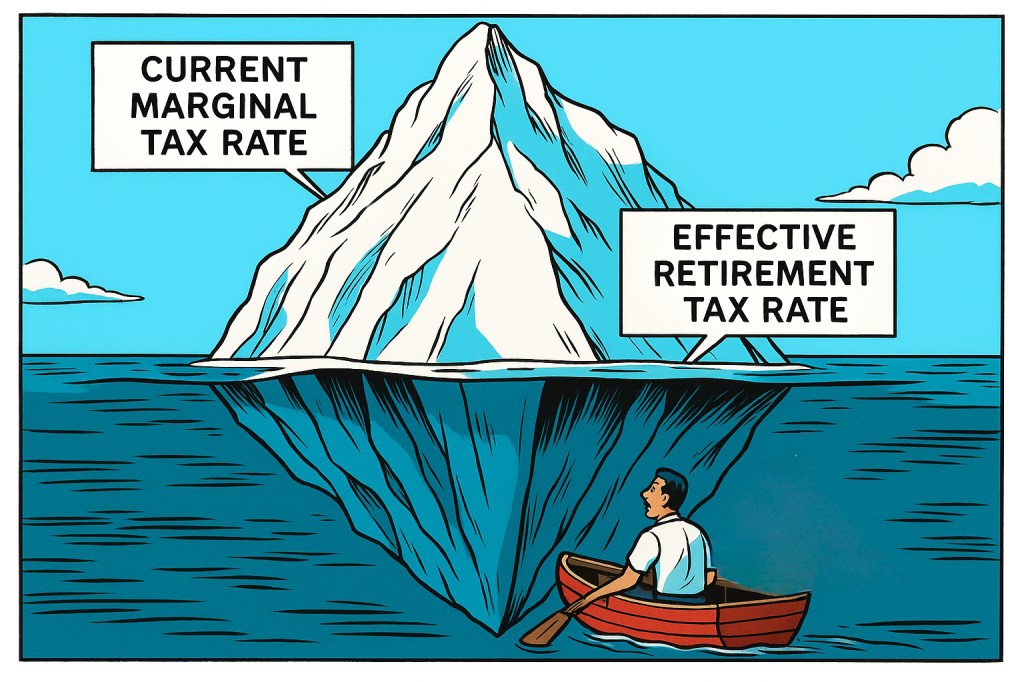

How Progressive Taxation Flips the Script on Investment Decision Making

I started reading Sean Mullaney and Cody Garrett’s Tax Planning To and Through Early Retirement recently. I was happy to see Mullaney and Garrett break down the math behind Roth vs. Traditional accounts. Far too many financial planners and influencers use overly simplistic math, stoke fear about impending tax timebombs, or just cheerlead for “tax…

-

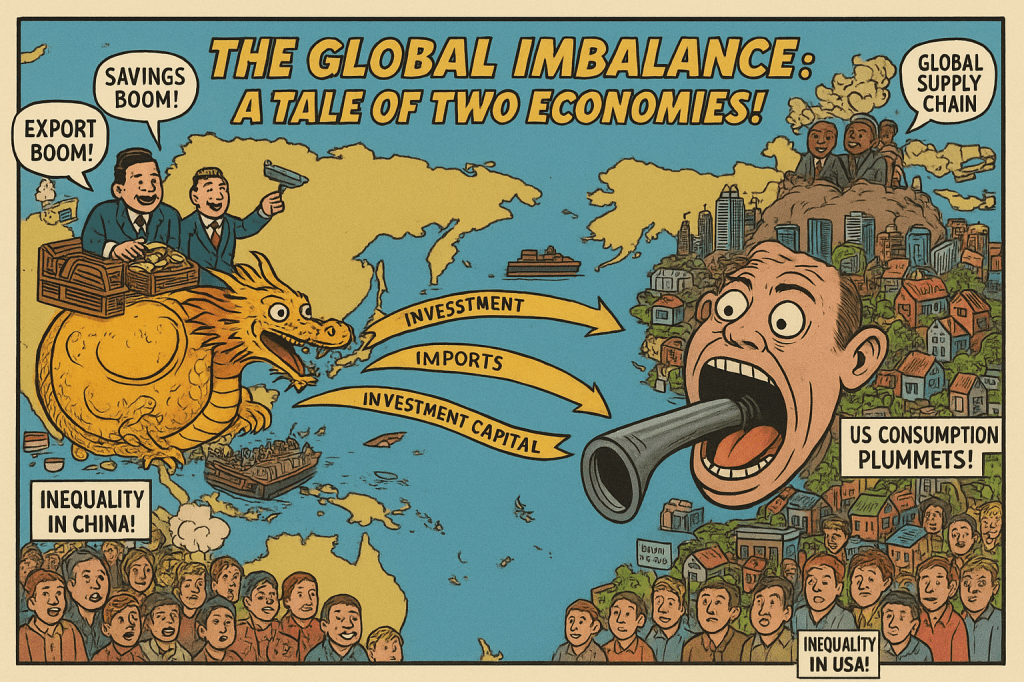

Structural Constraints on Financial Independence | Part 2

Last week, we argued against the dominant narrative that low household savings and poor retirement outcomes are due to individual deficits in financial education or personal thrift. In doing so, we introduced the “Paradox of Thrift,” explaining how widespread aggressive saving can harm the economy by reducing aggregate demand. We also discussed how asset price…

-

Structural Constraints on Financial Independence | Part 1

Financial Independent (FI) culture, and the broader social and academic discourse, is dominated by a seemingly benevolent, yet deeply flawed, narrative: that low household savings and poor retirement outcomes are primarily the result of individual deficits in “financial education” or personal thrift. This paradigm, heavily promoted by financial institutions and often echoed in public policy,…

-

The Fetish of Financial Freedom: A Critique of the FIRE Movement

The Financial Independence (FI) or Financial Independence Retire Early (FIRE) movement presents a powerful and compelling vision of modern economic liberation. It offers an alternative to the 40 year career and the stress of living paycheck to paycheck. At its core, the movement promises a strategic escape from what some adherents describe as wage slavery,…

-

The CAPE ratio, the Merton Share and Your Asset Allocation | Part 3

In the previous two articles, we teased the Merton Share as a rational framework for portfolio asset allocation. Now, let’s dive into how you can use both the CAPE ratio and the Merton Share to align your portfolio with your investing horizon, risk appetite, and current market valuations, without constant tinkering.

-

The CAPE ratio, the Merton Share and Your Asset Allocation | Part 2

Last week we discussed how the CAPE ratio of the S&P 500 is historically high at over 37, making the expected return on equities relatively low. And when we compare the earnings yield to the real return on 10-year TIPS, we see that the “equity risk premium” is quite small today. However, predicting the future is tough,…

-

The CAPE ratio, the Merton Share and Your Asset Allocation | Part 1

If you’re part of the Financial Independence (FI) community, you’ve probably built your retirement dreams on a pretty common assumption: stock market returns average 8–10%. To be fair, the S&P 500 has delivered, hitting a 10.2% compound annual return from 1928 through 2024. Popular FIRE calculators like Networthify err on the conservative side and dial…

-

How a Water Heater Can Increase Your Wealth

Energy efficiency may be boring, but it can be an incredibly lucrative investment What if I told you there is a way to make a 20 percent annual return on your investment over the next 13 years? What if I also told you that you could make that return with the same low risk associated…

-

Is Your Car Holding You Back Financially?

According to the Bureau of Labor Statistics, the average American spent 16.4 percent of their budget on transportation expenses in 2021. Experts, however, recommend limiting your transportation budget to 10–15 percent of your income. As transportation costs have climbed faster than inflation during the last few years, understanding your vehicle’s true costs are more important…

-

Here’s How Much You Really Need to Save for Retirement

Planning for retirement spending is one of the more nuanced parts of financial planning. The Financial Independence community commonly follows the “4% rule,” which was first developed by Bill Bengen in a 1994 paper and later expounded upon in the Trinity Study. The 4% rule dictates that a properly designed portfolio should last at least…