Tag: Economics

-

Can Trump Accounts and Superannuation Help Us Afford the Future?

President Trump recently announced a donation of $6.25 by Michael and Susan Dell to kick-start new investment accounts, dubbed “Trump Accounts,” for 25 million qualified American children under 11 years of age. Trump Accounts were established as part of the One Big Beautiful Bill Act (OBBBA) and provide tax deferral for families with children.

-

Stock Buybacks: A Misallocation of Capital or an Easy Target?

I recently came across two interesting pieces on stock buybacks, which I’ve been meaning to cover at the Fictitious Capitalist. For those who are unfamiliar, stock buybacks—also called share repurchases—are when a company uses its own cash to buy back its shares from the open market (or directly from shareholders). Once repurchased, those shares are usually…

-

Structural Constraints on Financial Independence | Part 2

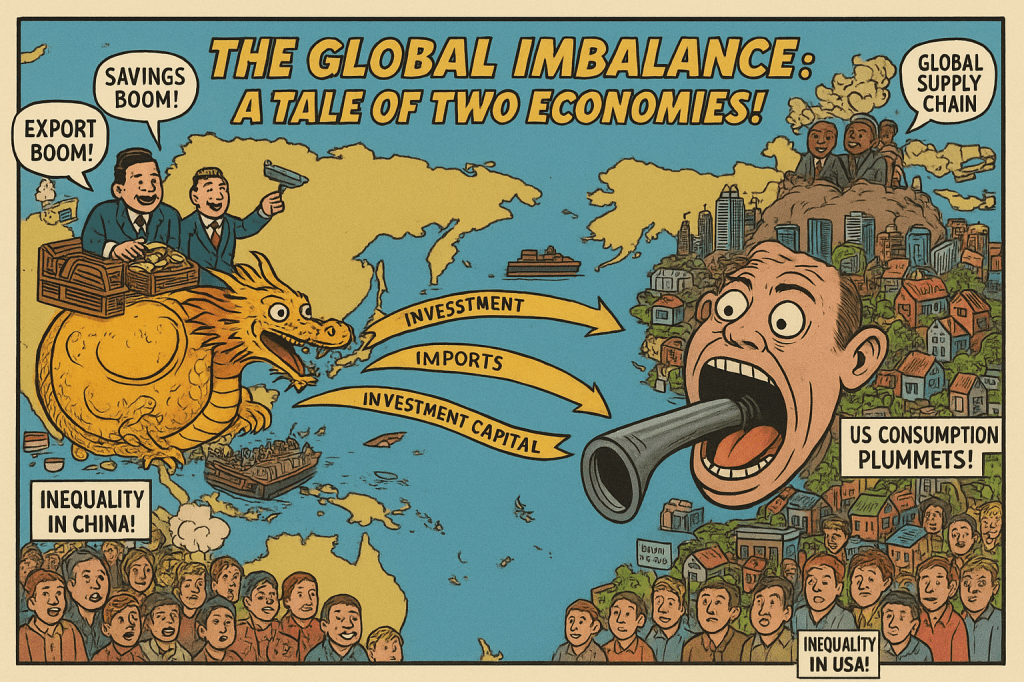

Last week, we argued against the dominant narrative that low household savings and poor retirement outcomes are due to individual deficits in financial education or personal thrift. In doing so, we introduced the “Paradox of Thrift,” explaining how widespread aggressive saving can harm the economy by reducing aggregate demand. We also discussed how asset price…

-

Structural Constraints on Financial Independence | Part 1

Financial Independent (FI) culture, and the broader social and academic discourse, is dominated by a seemingly benevolent, yet deeply flawed, narrative: that low household savings and poor retirement outcomes are primarily the result of individual deficits in “financial education” or personal thrift. This paradigm, heavily promoted by financial institutions and often echoed in public policy,…

-

The People’s Portfolio: Social Wealth Funds as Collective Capital

In February, President Trump announced the intent to establish a sovereign wealth fund for the United States. More recently, the Commerce Secretary announced that the U.S. had taken a 10% ownership share in Intel. The acquisition of the microprocessor juggernaut’s equity is part of a larger plan to acquire more strategic companies as a “down…

-

The Fetish of Financial Freedom: A Critique of the FIRE Movement

The Financial Independence (FI) or Financial Independence Retire Early (FIRE) movement presents a powerful and compelling vision of modern economic liberation. It offers an alternative to the 40 year career and the stress of living paycheck to paycheck. At its core, the movement promises a strategic escape from what some adherents describe as wage slavery,…

-

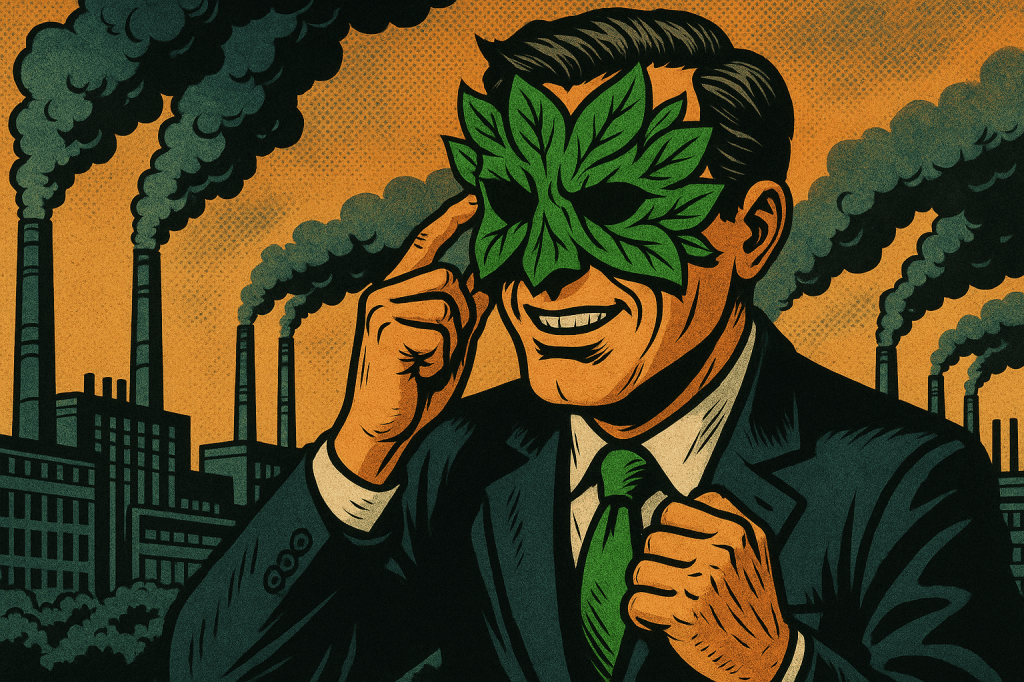

Beyond the Green Veil: An ESG Postmortem | Part 2

Welcome to the second of three blog posts about the rise and fall of Environmental, Social and Governance (ESG) investing. Last week, we discussed the history of ESG investing along with made by proponents of ESG. This week we’ll discuss some of the popular critiques of ESG and their more academic equivalents. Let’s jump in…

-

Beyond the Green Veil: An ESG Postmortem | Part 1

Environmental, Social, and Governance (ESG) investing emerged as a purportedly transformative force in the financial world, growing at a breakneck pace until very recently. It promised a pathway to align the often-disparate goals of generating superior financial returns with achieving broader environmental and social objectives. This burgeoning asset category, encompassing a wide and evolving array…

-

Fictitious Capital and Why It Matters Today

The name “Fictitious Capitalist” might raise an eyebrow or two, and it is intended to do so. It’s a deliberate play on a profound concept from the economist and philosopher Karl Marx: fictitious capital. In his magnum opus, Das Kapital, Marx introduced the idea of “fictitious capital” to describe financial assets like stocks, bonds, and other derivatives.…