-

The Stock Market’s Longest Losing Streak

I was recently working on an asset-liability matching exercise for my financial plan. Asset-liability matching is exactly what it sounds like: a financial strategy where you match your investment assets (stocks, bonds and cash) with your liabilities (debts and spending). The core idea is to match the timing of cash needs with asset liquidation or…

-

The People’s Portfolio: Social Wealth Funds as Collective Capital

In February, President Trump announced the intent to establish a sovereign wealth fund for the United States. More recently, the Commerce Secretary announced that the U.S. had taken a 10% ownership share in Intel. The acquisition of the microprocessor juggernaut’s equity is part of a larger plan to acquire more strategic companies as a “down…

-

The Fetish of Financial Freedom: A Critique of the FIRE Movement

The Financial Independence (FI) or Financial Independence Retire Early (FIRE) movement presents a powerful and compelling vision of modern economic liberation. It offers an alternative to the 40 year career and the stress of living paycheck to paycheck. At its core, the movement promises a strategic escape from what some adherents describe as wage slavery,…

-

From Market Noise to Economic Footprint | Part 2

If you are interested in fundamental weighting, several prominent asset management companies have created fundamentally-weighted index funds. Many of these funds are based on the FTSE RAFI series of fundamental equity indexes, which have been compiled in collaboration with Research Affiliates since 2005. These indexes are constructed using a combination of four core fundamental measures:…

-

From Market Noise to Economic Footprint | Part 1

With the Magnificent 7 stocks now representing close to 35% of the S&P 500, it might be a good time to review how these indexes are composed. If you are in the Financial Independence (FI) community, you are most likely familiar with market capitalization (cap-weighted) indexing, an approach used in major benchmarks like the S&P…

-

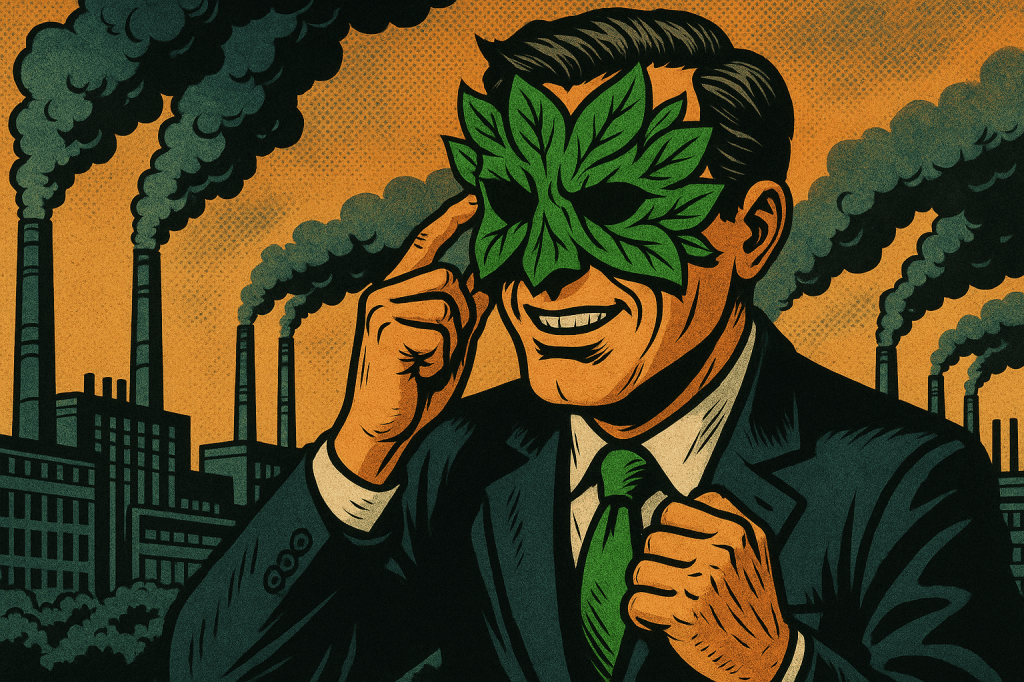

Beyond the Green Veil: An ESG Postmortem | Part 3

In the previous two posts, we explored how ESG became a worldwide phenomenon, how it courted political controversy and generated critique from politicians, armchair economists and academic journals. In this final post, we’ll explore some deeper critiques through the lens of Marxist economics and offer some potential social democratic and market socialist alternatives to ESG…

-

Beyond the Green Veil: An ESG Postmortem | Part 2

Welcome to the second of three blog posts about the rise and fall of Environmental, Social and Governance (ESG) investing. Last week, we discussed the history of ESG investing along with made by proponents of ESG. This week we’ll discuss some of the popular critiques of ESG and their more academic equivalents. Let’s jump in…

-

Beyond the Green Veil: An ESG Postmortem | Part 1

Environmental, Social, and Governance (ESG) investing emerged as a purportedly transformative force in the financial world, growing at a breakneck pace until very recently. It promised a pathway to align the often-disparate goals of generating superior financial returns with achieving broader environmental and social objectives. This burgeoning asset category, encompassing a wide and evolving array…

-

The CAPE ratio, the Merton Share and Your Asset Allocation | Part 3

In the previous two articles, we teased the Merton Share as a rational framework for portfolio asset allocation. Now, let’s dive into how you can use both the CAPE ratio and the Merton Share to align your portfolio with your investing horizon, risk appetite, and current market valuations, without constant tinkering.

-

The CAPE ratio, the Merton Share and Your Asset Allocation | Part 2

Last week we discussed how the CAPE ratio of the S&P 500 is historically high at over 37, making the expected return on equities relatively low. And when we compare the earnings yield to the real return on 10-year TIPS, we see that the “equity risk premium” is quite small today. However, predicting the future is tough,…

Fictitious Capitalist

Wealth for the many.