I started reading Sean Mullaney and Cody Garrett’s Tax Planning To and Through Early Retirement recently. I was happy to see Mullaney and Garrett break down the math behind Roth vs. Traditional accounts. Far too many financial planners and influencers use overly simplistic math, stoke fear about impending tax timebombs, or just cheerlead for “tax free growth” without questioning why.

Roth accounts have their place and can reduce total tax liability, but do so often at the expense of total consumption and after-tax wealth. How is it possible that lower tax obligations could lead to lower spending and lower wealth in retirement? In order to evaluate the impact of asset location on tax treatment, after-tax wealth and consumption, it is helpful to understand the difference between marginal and effective tax rates.

Marginal tax rates are commonly quoted as your “tax bracket” and represent the tax rate paid on incremental increases in your income. For example, if you are in the 22% tax bracket, for each additional dollar you earn, 22 cents is due in taxes (until you reach the next tax bracket, that is).

Effective tax rates are different and represent the weighted average marginal tax rate on your income. A simple way to calculate your effective tax rate is to take the total amount you paid in taxes in a given year and divide it by your gross income. A single earner in the 22% tax bracket might only pay a 13.7% effective tax rate because the first $14,600 wasn’t taxed due to the standard deduction, the next ~$12,000 of taxable income was taxed at 10%, the next ~$36,500 at 12%, and so on.

| Marginal Tax Rate | Taxable Income in Tax Bracket | Tax Amount |

|---|---|---|

| 0% | $14,6001 | $0 |

| 10% | $11,925 | $1,192.50 |

| 12% | $36,550 | $4,386 |

| 22% | $36,925 | $8,123.50 |

| Total | $100,000 | $13,702 |

In the case above, the taxpayer’s weighted average marginal (effective) tax rate is $13,702 / $100,000 = 13.7%, even though they are in the 22% tax bracket. Few people seem to understand the difference between marginal and effective tax rates, but it is a critical aspect of progressive income taxes that can’t be overlooked. Once you understand the difference though, it quickly becomes apparent how it affects the Roth vs. Traditional debate.

The “simple math” would suggest that a 22% marginal tax paid today (Roth) is no different than a 22% marginal tax paid in Retirement (Traditional). But that isn’t what we’re comparing.

Explicitly, we are comparing the 22% marginal tax cost from Roth to the weighted average marginal tax rate from Traditional in retirement. In many cases, the weighted average marginal tax rate in retirement will be lower than the taxpayer’s current marginal tax rate, which would favor Traditional over Roth. Specifically, if your taxable income (including required minimum distributions) is the same in retirement as it was during your working years, you would be better off in Traditional, all things being equal.

To demonstrate this, consider a 40-year-old investor earning $100,000 pre-retirement, who contributes $20,000 pre-tax to a retirement account. The investments grow at 4.82%2 after-inflation for 20 years, at which time the investor retires and withdraws the compounded after-tax investment to consume as income.

For simplicity purposes, I’ve assumed the investor takes the standard deduction. I’ve used the same taxable income brackets listed above for a single filer in 2025. I assume that the investor will spend at least the same amount in retirement that they do as a wage earner, but that spending in one year of retirement will be determined based on the return achieved roughly from one year of savings ($20,000 roughly doubles in 20 years at 4.82% to $40,000, with an additional $40,000 received from Social Security, which means that the investor is spending $80,000 before and after retirement). The table below shows the tax earnings, contributions and tax savings from Traditional over Roth during a single earnings year.

| Current Gross Income | $100,000 |

| Contribution Amount (Traditional) | $20,000 |

| Contribution Amount (Roth) | $15,600 |

| Real Return (per year) | 4.82% |

| Years Until Withdrawal | 20 |

| Future Value (Traditional) | $51,282.04 |

| Future Value (Roth) | $40,000 |

My calculations assume the investor only has $20,000 to invest, while the rest must go to tax and spending obligations. This means that the Roth account would only be funded to $15,600 because of the investor’s 22% marginal tax rate.

None of this should be in dispute. If you assume that the Roth investor would invest the same $20,000 as the Traditional investor, you imply that the Roth investor is curtailing consumption after taxes, making it an unfair comparison (This is Dave Ramsey’s mistake). The Traditional investor could invest additional funds in a brokerage account, but we’re keeping the investment at $20,000 pre-tax to keep things simple.

The Traditional account’s future value is ~28% higher than the Roth because the initial investment was also ~28% higher ($4,400 / $15,600 = 28.2%). The only differentiating factor at this point will be the difference in taxes paid under each scenario and the total amount available for consumption in retirement.

The next table shows the effect of the investment decision on tax obligations and final after-tax asset values post-retirement.

| Roth | Traditional | |

|---|---|---|

| Tax Obligation (Pre-Retirement) | $13,702 | $9,302.00 |

| Tax Obligation (Post-Retirement) | $2,809.50 | $9,910.72 |

| Total Tax Obligation | $16,511.50 | $19,212.72 |

| Retirement Income (Social Security) | $40,000 | $40,000 |

| Retirement Income (Portfolio) | $40,000 | $42,766.93 |

Clearly, the Roth investor paid less in taxes over the full investment horizon (mission accomplished), but the Traditional investor had more spending money, despite paying over $2,500 more in taxes. So, what happened here? In short, the progressive income tax coupled with investment growth.

Higher income is taxed at higher marginal rates. The tax “savings” (as a percentage of income) the Roth investor saved on the way out was more than offset by the savings the Traditional investor saved on the way in. In other words, the marginal rate (22%) paid by the Roth investor is more than the weighted average marginal rate (16.6% in this case) paid by the Traditional investor in retirement.

Roth fans might protest that income tax rates are likely to go up or the investor might get kicked into a higher tax bracket when RMDs start. It is true that this is a risk, but it shouldn’t be oversold. For one, Congress keeps cutting taxes, especially for retirees. And, even if the 22% bracket went to 30%, the investor would still be better off in a Traditional account. On the other hand, getting “kicked into” a higher tax bracket because your investments did well is a problem we should all hope for—it means we have higher income.

There are more sophisticated models comparing Traditional and Roth accounts that include future return and tax uncertainty, but even then Roth is not a clear winner. As usual, there appear to be trade-offs between risk and return.

Let me be clear: I am not saying Roth accounts serve no purpose. They are a great hedge against much higher tax rates in the future. They also can serve as an income crutch in early retirement (basis can be pulled penalty-free), help to strategically reduce tax obligations or to qualify for Obamacare subsidies. Furthermore, certain high income earners may not qualify for a tax deduction in a Traditional account, and Roth is undoubtedly better than a brokerage account.

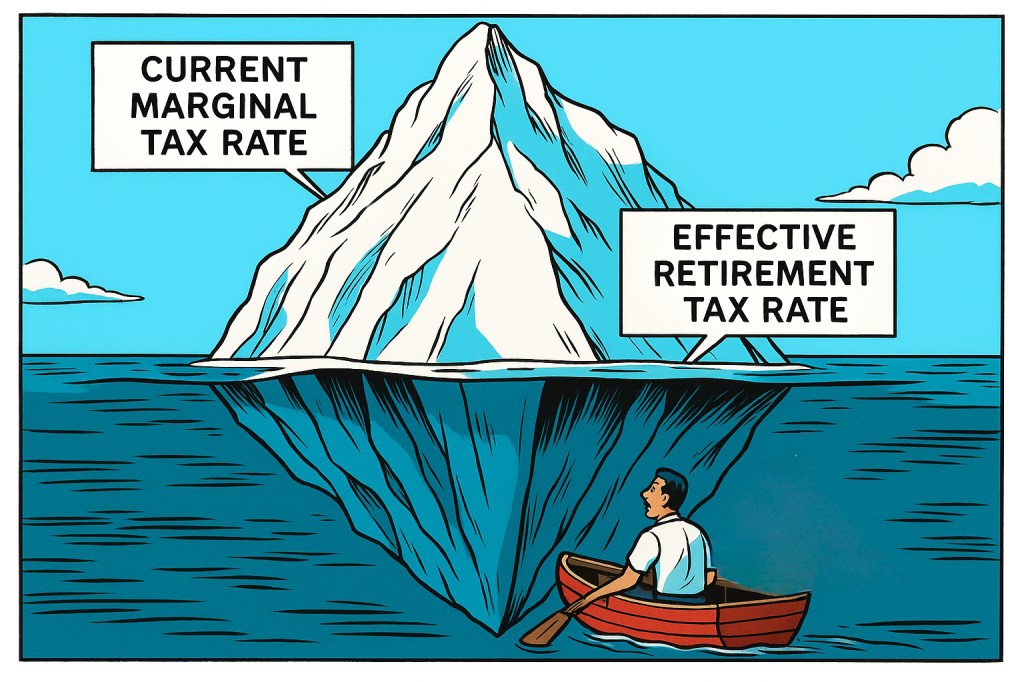

Roth accounts are not the “tax tail wagging the dog,” but it might be that the tax “tip of the iceberg” (marginal rate pre-retirement) really is larger than the underwater portion (effective rate post-retirement). Okay, that metaphor didn’t work so well, but the cover image makes more sense now, right?

- I’m oversimplifying the tax treatment here by using the standard deduction as a 0% tax bracket. If the taxpayer itemizes, they may end up having lower taxable income which could reduce their tax obligations further. ↩︎

- This growth rate sounds random, but it wasn’t. 4.82% is the exact amount of growth required to double the initial pre-tax Roth investment of $20,000 in 20 years. This was done so that the investor could meet their future spending obligations of $40,000 through the investment of $15,600 (post-tax) in the present day. ↩︎