Welcome to the second of three blog posts about the rise and fall of Environmental, Social and Governance (ESG) investing. Last week, we discussed the history of ESG investing along with made by proponents of ESG. This week we’ll discuss some of the popular critiques of ESG and their more academic equivalents. Let’s jump in to see if we can better understand why ESG failed to live up to its promise.

Popular Critiques and Their Limitations

Many widely circulated arguments against ESG investing fall flat after a cursory review. Politically charged or economically simplistic, these critiques tend to miss the fundamental flaws embedded within capitalism itself that are simply reproduced in the ESG discourse. Here we present some of the more prevalent arguments championed by political and media personalities:

- Market Distortion: A frequent popular critique asserts that ESG uniquely distorts markets by diverting capital based on non-financial criteria, leading to inefficient capital allocation. This argument, however, overlooks the irrational nature of financial markets under capitalism. Investors constantly make decisions based on a myriad of factors, including irrational beliefs, poorly-founded claims, and speculation. Financial markets are perpetually influenced by extraordinary popular delusions and ESG simply introduces another set of considerations. Critics who contend that ESG distorts market mechanisms by favoring certain companies, potentially inflating their value or undervaluing others, often disregard the pervasive non-fundamental influences already present in capital allocation.

- Woke Capitalism: A particularly prevalent attack labels ESG as “woke” or “too politicized,” framing it as an imposition of a liberal (or even socialist) agenda on corporations and investors. This rhetoric, however, often functions as a red herring, effectively diverting attention from substantive issues. Right-wing conservatives have actively weaponized ESG, viewing it as part of a woke capitalism agenda that unfairly advantages Democratic priorities and disadvantages industries like fossil fuels. This ideological backlash is so strong that even major financial institutions like Blackrock have reportedly abandoned the ESG label in favor of less contentious terms like transition investing. The woke capitalism critique, however, reveals itself as a deliberate ideological weapon designed to frame systemic issues as partisan preferences and suffers from the same thing it claims to be critiquing. You would think, given their objections, that the antidote to ESG would not be an anti-ESG fund or biblically aligned investing, but politicization appears to work both ways.

- Distraction from Profit: Critics frequently argue that ESG initiatives distract companies from their core business functions and their primary responsibility to generate profits for shareholders. Similarly, they accuse asset managers who consider non-pecuniary (non-financial) ESG factors of violating their “fiduciary duty” to maximize returns for their clients. However, this perspective often overlooks the strategic ways in which companies integrate ESG. Businesses often use ESG not as a distraction, but as a means to attract customers, raise capital, and charge higher prices (see Apple), thereby enhancing long-term profitability and competitive advantage. Capitalism is highly adaptable, and when “green” or “socially responsible” practices become market advantages—for example, by attracting capital, mitigating risk, or improving brand image—firms will adopt them as part of their profit-seeking strategy. This represents not a departure from the profit motive but an evolution of it. Far from challenging capitalism, it becomes another tool for its reproduction and expansion.

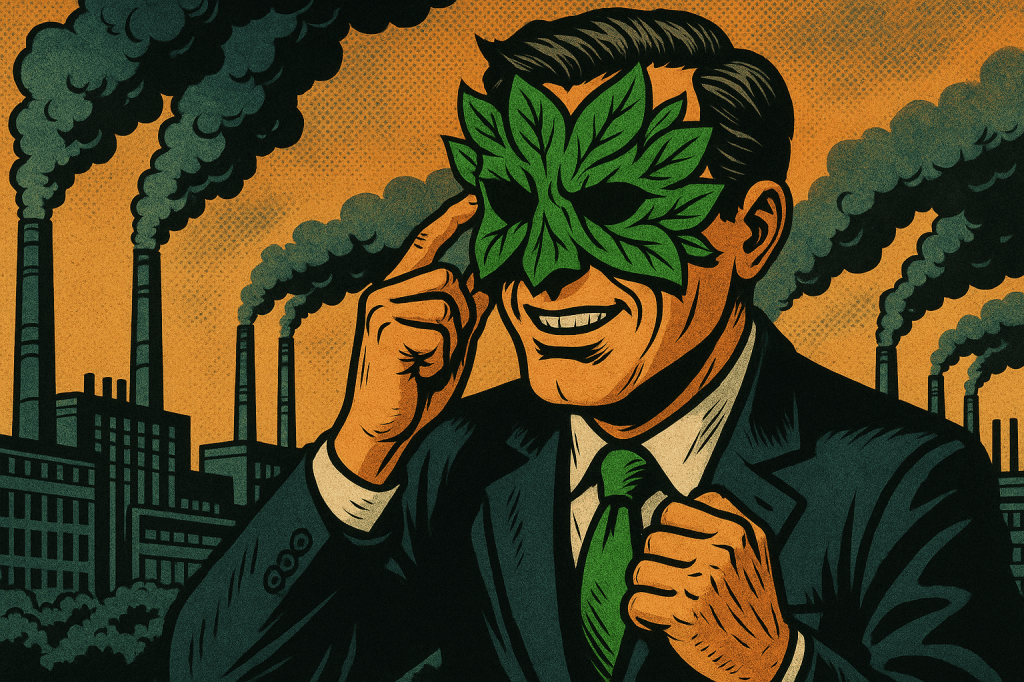

- ESG as Scam/Greenwashing: The accusation that ESG is simply a “scam” is a popular, albeit simplistic, dismissal. While some ESG positioning may be deceptive, such a broad generalization misses crucial nuances. If ESG as a whole is a scam, then so too is all of marketing, branding and public relations. However, a more critical perspective reveals that greenwashing—what Joe Williams at Cardiff University calls the “false or misleading claims and symbolism to give an impression of a company or organisation’s commitment to environmental protection and sustainability” —is not merely isolated corporate deception. Greenwashing, rather than being an isolated “scam,” is a symptomatic manifestation of capitalism’s inherent drive to generate profit from everything, including from environmental and social awareness, without fundamentally altering its exploitative and extractive logic. This is a systemic incentive problem, not merely a moral one: If the market rewards the appearance of sustainability, capital will naturally provide that appearance. Capitalism continues its accumulation process while appearing to address crises, thereby deflecting genuine critique and delaying necessary structural change.

Conventional Critiques from Finance and Economics

Beyond the popular dismissals, more sophisticated criticisms of ESG, often raised by economists, business leaders and traditional finance professionals, highlight genuine limitations within its current framework. These concerns point to structural issues that even well-intentioned ESG initiatives struggle to overcome. We will discuss four particularly strong ones here:

- The Indirect Impact of Secondary Market Investing: In contrast to last week’s post about ESG reducing the cost of capital, a significant and academically supported critique highlights that ESG investing in secondary markets, such as publicly traded stocks and bonds, has a limited direct impact on corporate behavior. Investors in these markets typically purchase shares from other investors, not directly from the companies themselves. This means the effect on the companies’ cash flows or operational decisions is, at best, indirect. Research from Harvard Law corroborates that “divestment in secondary markets is unlikely to materially change the way companies operate,” as such transactions “merely shift ownership rather than directly influencing the cash flows of the firm.” The potential for divestment to affect corporate behavior relies on indirect mechanisms, such as new shareholders exercising control or changes in the company’s cost of capital. However, at current levels of socially conscious investing, which represent less than 2% of stock market wealth in the United States, these effects are “too small to materially affect company behavior”. While direct stock and bond purchases made in the primary market (such as through venture capital), may be more effective, the vast majority of non-accredited investors have no access to such investments. The common perception that buying ESG funds directly “helps” companies become greener or more socially responsible does not hold water because the financial market, particularly secondary trading, operates largely independently of direct productive investment decisions. If investments are primarily claims on future profits rather than direct injections into productive assets, their ability to steer real-world corporate behavior toward social or environmental ends is constrained.

- Questioning Superior Returns: The assertion that ESG investing consistently delivers superior financial returns is a subject of ongoing debate and mixed evidence. While many studies suggest a positive correlation between ESG performance and financial outcomes, particularly over longer time horizons and in terms of downside protection during crises, other analyses do not. In fact, efficient market theory suggests that the significant inflow of capital into ESG funds might predict lower expected returns due to their perception as lower risk. Critics also argue that by excluding certain sectors or companies based on ESG criteria, investors might miss profitable opportunities, and that the emphasis on ESG compliance could lead to an overconcentration in currently fashionable sectors like technology stocks that may not deliver long-term sustainable returns. Even when positive correlations do exist, they are often linked to underlying good management, risk mitigation, or specific implementation strategies. If investors are looking for such premiums, a quality factor screen may capture them more effectively than ESG.

- The Standardization Conundrum: One of the most significant practical and conceptual challenges facing ESG is the profound lack of global consensus, standardization, and consistent metrics across its various dimensions. ESG funds may use completely different filters or scoring systems, making terms like “ESG,” “green,” or “social” unhelpful in understanding actual firm practices. Research confirms this, noting that ESG ratings from different vendors often show low correlation, with an average match of only 61% according to MIT research, creating a “maze of conflicting and confusing signals“. This opacity and the reliance on a complex web of non-harmonized frameworks, make it difficult for investors to make informed decisions and for companies to be fairly compared.

- Conflicting Priorities and Implementation Hurdles: Beyond data standardization, the very breadth of ESG—encompassing environmental, social, and governance issues—creates inherent challenges due to potentially conflicting priorities. Critics find ESG overly broad and difficult to implement. Paul Mueller at the American Institute for Economic Research writes that there is “no clear connection, or even correlation,” between the Environmental, Social and Governance components. For example, an environmental initiative might lead to job losses, or a governance decision might prioritize shareholder value over community well-being. He continues, writing, “The social category has the most ideology and the least connection to company performance and profitability,” making it particularly contentious. This internal incoherence means that pursuing one ESG goal might inadvertently undermine another, leading to difficult trade-offs and a fragmented approach to sustainability. Others highlight the “fundamental tension between economic growth, social equity, and environmental protection,” which ESG attempts to reconcile within a single framework but often struggles to do so in practice.

While popular arguments against ESG express the political and economic tension between competing ideologies, the deeper critiques are not so easily dismissed. We now see how ESG, while it may have some virtues as hedge against risk or an expression of personal ethics, is fairly limited in its impact on markets and has struggled to define itself consistently. Next week we’ll return to this topic with a discussion of several core lines of critique that have been missing from the ESG debate. We’ll discover why ESG was always doomed to fail as a means of transforming the economy and uncover more promising alternatives.

See you then!

You must be logged in to post a comment.