Calculate the savings rate you need to retire on time

Planning for retirement spending is one of the more nuanced parts of financial planning. The Financial Independence community commonly follows the “4% rule,” which was first developed by Bill Bengen in a 1994 paper and later expounded upon in the Trinity Study.

The 4% rule dictates that a properly designed portfolio should last at least 30 years with an inflation adjusted initial withdrawal of 4% of the total portfolio. In other words, based on historical data, an individual could safely retire once their portfolio reaches 25 times their annual expenses[1].

The 4% rule forms the backbone of several retirement income calculators, including ficalc.app and Networthify. Many online calculators will backtest various portfolio asset allocations, let you modify the withdrawal rate, increase savings, or adjust the initial portfolio value.

Networthify is particularly useful because it leverages the intuition that annual investment savings is simply your annual income minus your annual expenses. If you expect to spend the same amount in retirement as you do during your working life, Networthify will help you calculate the amount of time to retirement, given an initial withdrawal rate and an expected return on investment.

Networthify is somewhat limiting though because you need to select a savings rate first in order to figure out when you can retire. However, what if you wish to retire in 10 years, and have a nest egg of $250,000 today? What savings rate is necessary to achieve that goal and still maintain your current quality of life?

While Networthify does provide a nice chart plotting a rounded savings rate along with the years to retirement, it isn’t exact and you need to plug in your information each time in order to see your progress. To make it more convenient, you might consider setting up a quick link by replacing the income, initial balance, expenses, annual growth rate, and initial withdrawal rate in the URL below:

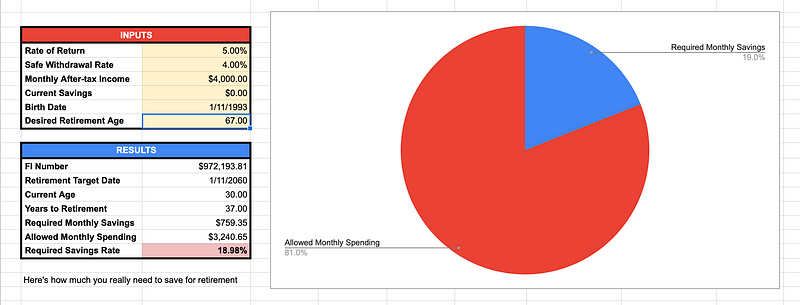

I created a Google Sheet here with each of the required fields so you can insert your own information (be sure to make a copy of the sheet first; otherwise, you can’t edit it). This way you can easily revisit your target date if your income or asset value changes significantly.

But I’m still frustrated with this approach.

Required Savings Rate Calculator

Online retirmenent calculators like Networthify still leave me wondering: If I identify a retirement date or age, a safe withdrawal rate, and an investment rate of return, can I calculate the precise savings rate required to retire on time? If I have investments already, how much does my current portfolio value reduce the required savings rate and increase the spending rate?

Suppose, as an example, a 30-year-old wage earner with a standard retirement age of 67, choose a 4% initial safe withdrawal rate in retirement. Expected returns are a controversial topic, but a 5% real return (after inflation) is relatively conservative historically[2], especially if you have high equity concentrations prior to retirement, as you probably should.

With an investment horizon of 37 years, the investor’s savings amount must be enough to meet their spending needs in retirement — remember, the spending rate is simply 100% of your income minus the savings rate — from an initial safe withdrawal of 4% of their portfolio.

So, how much does our investor need to save? Well, if the current portfolio value is $0, the required savings rate would need to be 18.98% of current income. However, there are a few other variations the investor might consider:

- If the 30-year-old had existing portfolio assets totaling $100,000, the required savings rate would decrease to 14.23%.

- If the 30-year-old wanted to retire early at age 55 (with $100,000 in existing portfolio assets), the required savings rate would be 28.89%.

- If the 30-year-old was more risk averse and wanted to model a 3% annual safe withdrawal rate with an age 55 retirement, the required savings rate would be 36.04%.

- Finally, if the 30-year-old had a less aggressive stock portfolio and expected annual returns of just 4% after inflation (and all the above listed considerations), the required savings rate would increase to 40.24%

So, where do these precise required savings rates come from? Luckily there is a not-so-simple formula for determining the required savings rates mentioned above. That formula is detailed below. However, if you aren’t interested in the math behind it, you can check out this Google Sheet that calculates the required savings rate.

Using the Required Savings Rate Calculator, you input your birthday and expected retirement age, your initial safe withdrawal rate, your expected rate of return, your income (I would use after-tax income but it only matters if you have significant savings), and your current portfolio value. The resulting required savings rate is the percent of your income you need to save and invest in order to maintain the same standard of living in retirement.

You can use the calculator to make regular adjustments to your savings rate depending on your investments’ performance. If your investments outperform, you could choose to move up your retirement date, or keep the same timeframe and reduce your savings rate appropriately. If your investment underperforms, you would do the opposite — move back your retirement date or increase your savings rate[3].

Note that this calculator does not take into consideration other sources of income like Social Security or rental income, nor does it consider pre-tax vs. Roth sources of income, but may be used as a general guide to savings rates with a specific retirement date in mind. It also cannot incorporate market risks, longevity risks and other factors that may influence your outcomes.

The Formula Behind the Calculator

For those of you who are interested, here’s how the formula works. As Networthify and the Required Savings Rate Calculator assume, you will likely have the same spending requirements in retirement as during working years[4]. So, the real initial safe withdrawal amount is equal to the real spending amount during a given frame of reference, say a one month period. This means that the target portfolio value at retirement is a multiple of the spending amount. For example, if someone spends an inflation-adjusted $4,000 per month before retirement, the monthly safe withdrawal amount should also be $4,000 per month, and if the initial safe withdrawal rate is 4% of the portfolio in the first year, the required portfolio value is $1,200,000 ($4,000 x 12 months / 0.04).

So, what savings rate is needed to reach the required portfolio value by the specified retirement date? Interestingly, if the initial portfolio balance is zero, the savings rate can be expressed solely in terms of the initial safe withdrawal rate, the return on investment and the length of time until retirement. The required savings rate is completely independent of income or the saving and spending amounts.

The formula expresses the required savings rate s0 prior to time n that is needed to maintain the same level of spending in real dollars when withdrawals begin. This formula takes into account the initial withdrawal rate (w), the rate of return on the investment (i), and the number of years until withdrawals begin (n).

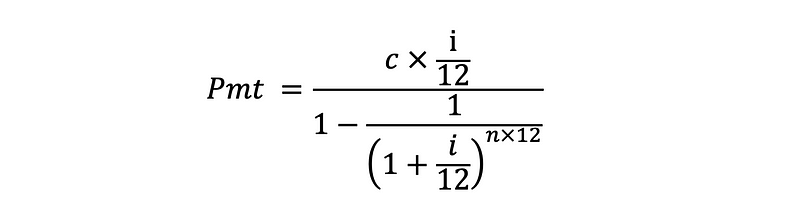

The formula gets more complex once you add in an initial portfolio balance. In order to determine the impact of an initial balance on the required savings rate, you need to understand the stream of payments that the balance represents. In other words, how much would you need to invest per month in order to reach the same value that the initial portfolio would reach at retirement. This is the periodic payment formula expressed in terms of a portfolio’s present value:

This periodic payment must then be added to total monthly income and multiplied by the Required Savings Rate determined by the initial formula for s0 above. This is the amount of savings required to meet the spending requirement by the retirement date if the periodic payment were treated as income. However, since the periodic payment is not income, but existing portfolio assets, it can be subtracted from the total, leaving the required monthly savings.

Expressed in terms of sm, required monthly savings, the formula looks like this:

The Required Savings Rate (s) is simply the required monthly savings (sm) divided by Income (I) expressed as a percentage.

Unlike the simpler formula for s stated previously, in order to calculate the monthly savings rate, this formula requires a monthly income amount (I) because the initial portfolio value’s impact on the savings rate is relative to the monthly income of the individual.

And there you have it! I hope this primer allows you to recreate the formula in your own retirement calculator or budgeting spreadsheet.

[1] The 4% rule is hotly contested. So much so that it is strange to call it a rule in the first place. If you aren’t comfortable with it, you can adjust your withdrawal rate downward or choose a different withdrawal methodology.

[2] The reason I use inflation adjusted returns is that it makes modeling expenses much easier. To calculate your inflation adjusted returns, take your expected returns and subtract what you expect average inflation will be over your accumulation time period. I suggest using historical data, which supports an average inflation rate between 3.3% and 3.8%.

[3]Naturally, this method makes you save more during market downturns, which could help you improve your expected returns. If you increase your savings rate because your portfolio lost value you are buying more when the market is cheaper and less when it is relatively expensive.

[4]Research suggests that actual spending in retirement may be lower for many individuals and gradually decreases as the individual ages.